The strengthening of Albanian Lek and its effects

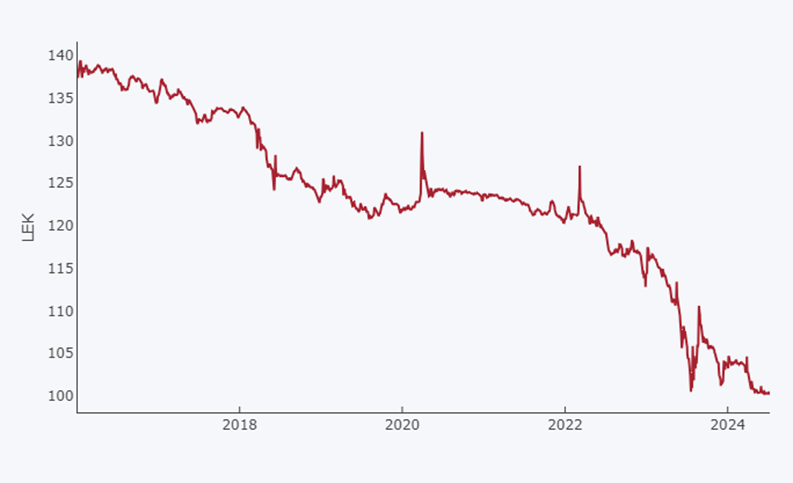

In recent years, the Albanian Lek (ALL) has shown a significant strengthening against the euro (EUR), reaching the highest ever level against the Euro at less than 100/1 (ALL/EUR), from a level of 137/1 in 2017. The trend has been continuing this year, albeit at a slower pace compared to 2023, when it registered a 12% annual increase. This appreciation has sparked extensive debate and analysis from economists, political commentators and business representatives.

The appreciation of the lek can be attributed to several intertwined economic and policy factors. One of the primary drivers is the improvement in Albania’s trade balance, linked particularly to the rise of the tourism sector, which has become a cornerstone of the Albanian economy. The influx of foreign tourists has brought in substantial amounts of foreign currency, boosting the demand for ALL. Additionally, the rise in remittances from the Albanian diaspora and the inflow of foreign direct investment (FDI) have played crucial roles in strengthening the local currency.

Moreover, the Bank of Albania has actively intervened in the foreign exchange market to manage the Lek’s value. These interventions, often through direct purchases of euros, have helped to an extend to stabilize the currency and prevent excessive volatility.

However, the strengthening of the Lek is not solely a result of positive economic fundamentals. The International Monetary Fund (IMF) has noted that the rapid appreciation of the Lek in recent years is not fully explained by economic factors alone. There are indications that informal economic activities may have contributed to this trend. The substantial influx of euros, potentially linked to the informal reflected predominantly by the construction boom in Albania, has raised concerns. The lack of comprehensive data on the real estate and construction activities further complicates the assessment of the full impact of these factors on the currency’s strength.

The effects of a stronger lek on the Albanian economy are multifaceted. On one hand, the appreciation has helped mitigate inflationary pressures by reducing the cost of imported goods and services. This has been particularly beneficial in maintaining somewhat lower inflation rates compared to the rest of the region, which in turn has supported the purchasing power of Albanian households. For borrowers whose incomes are in Lek and loans in foreign currencies, the stronger Lek has eased the burden of debt repayment, enhancing their financial stability. This has also helped the Albanian Government to reduce the debt burden from 75% of GDP in 2020 to 57% in 2024.

On the other hand, the stronger currency poses challenges, especially for the export-oriented sectors of the economy. Albanian goods and services become more expensive for foreign buyers, potentially reducing their competitiveness in international markets. This has been a particular concern for industries like textiles and manufacturing, which rely heavily on exports. The reduced competitiveness has led to lower sales and profit margins, ultimately affecting employment and economic growth in these sectors.

Furthermore, the rapid appreciation of the Lek carries risks of sudden reversals. The IMF has expressed concerns about the sustainability of the Lek’s strength, especially if it is driven by factors outside the formal economy. A sudden depreciation could destabilize the financial system, leading to increased volatility and uncertainty. Such a scenario would require careful management by the Central Bank to prevent disorderly market conditions and protect the broader economy.

The strengthening of the Albanian Lek is a complex phenomenon driven by a mix of positive economic developments and potentially less transparent factors. While the appreciation has brought several benefits, including low inflation and improved debt repayment capacity, it also presents significant challenges for Albanian exporters, as well as other businesses which have to deal with exchange rate volatility. The Bank of Albania should maintain a proactive approach to monetary policy, either through frequent interventions in the foreign exchange market or through imposing a currency peg between EUR and ALL, in order to ensure long-term predictability of exchange rates for business planning and help to promote exchange rate and economic stability.